Home > Grexit, first Act

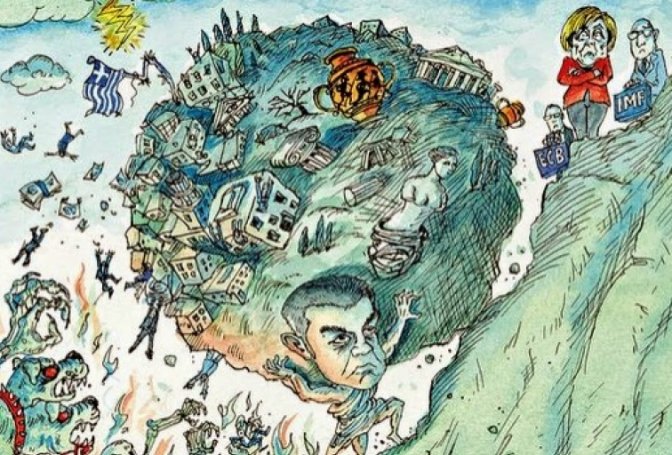

It was easy to expect that they would have made the Greeks pay for OXI, and so was it. In the light of the most harsh outcome of the "negotiation" between the Greek government and the Eurogroup, the discussion now revolves around pro- and anti-Tsipras stances - has he betrayed the people’s mandate or not? - and/or the question of whether the price to save Europe was maybe too hefty. A discussion, to say the least, that is out of sync. Actually, this "agreement" does not avoid the Grexit, but on closer inspection is its first act, and we ought to start from here.

Actually, given a minimum of realistic consideration, what should stand out is that the conditions of the European diktat are simply impracticable. Impracticable because of the predictable social and political consequences of the imposed "guardianship" (as the German daily Faz labeled it. Because the "investment plan" supposedly secured by Tsipras is a hoax - in order to be able to invest a billion euros, Greece would have first to transfer something of a 25-fold greater share into pro-bank and pro-interest repayment public trusts - so much for "growth". Because the Greek debt is going to increase further, and it is uncollectible already. But above all, because to put money in there will not be Europe, but it will be Athens itself, not only with privatizations but with the bail in of the Greek banks, now under full ECB control, being only a matter of time and meaning their recapitalization through requisition of current accounts (according to the Cypriot precedent). It is obvious that in a few months time everything will blow up, in one way or another. How is it possible not to even suspect that we are (for now) in front of a slow-motion Grexit?

From Berlin’s point of view, the agreement is actually devised in such a way as to not be actually disobeyed (beyond the various procedural obstacles that should be overcome in the end, from the supply of a transitional loan to the ECB measures concerning liquidity). And during the moment in which this will all be served by the communication war machine to European "public opinion" - not even the third package of "aid" was enough with these people! - it will be a de facto full Grexit (the legal forms will be timely found).

Was the "dramatic" Eurogroup meeting last Sunday just a mere political play? Not by chance: thanks to heavy pressure from the US - the true elephant in the Eurogroup room, assisted by the International Monetary Fund - Berlin was, temporarily, forced to postpone an immediate, unadulterated Grexit, but it stood firm enough to lay the basis for it in the short-medium term. With all the European governments that in one way or another accepted the German attitude - let’s not joke about non-existant French caveats, it is not even worth taking about Renzi - out of direct interests, of being diligent pupils or for fear of the Berlin-driven message (where in the meantime the government’s axis shifted from Merkel to favoring the Finance Minister Schäuble).

Perhaps some do not want to understand it, but we are at the beginning of Germany’s decoupling from this Europe, from how it was structured so far. We have already discussed elsewhere the reason of this "strategic retreat". For Berlin, the other possible Europe (and at this point a necessary one, too) is that of a nucleus of "Nordic" countries (France itself will have to sweat in order to fall within it) where the grip of fiscal, monetary and social policies (plus others) will be tightened as a precondition for a true political union, whereas those who cannot or do not want to comply will have to take a seat in one of the external concentric circles, before or more likely after having tasted true, Schäuble-flavoured, austerity. With this the German ruling class believes (or deceives itself? That it is able to face the challenges posed by the crisis and by the revival of the conflict among the great global players from a position of greater strength and without economic and political "dead weights".

At any rate, the messages of relief for the narrow escape by our local, day-after "fearless ones" [untranslatable pun here on "Prodi", which in Italian refers to both brave people and to the surname of pro-EU former President of the Council of Ministers - TN] sound both pathetic and self-comforting...

The attempts to look for support in the "sensibleness" of Washington and of the International Monetary Fund, as useful negotiating partners in containing and softening the German rigidity are equally self-relieving but, if possible, even more confusing. As for the IMF, the intervention of the American Lagarde, who edited with the red pencil the text that Merkel and Tsipras were agreeing on, is plainly forgotten - and it brought on the calling of the referendum. Now the memos about the unsustainability of Greek debt come out with, in the very least, an odd timing, but what for? In order to make Germany and the other European countries bear a substantial haircut of the Greek debt, this is the actual request - while the Fund pulls out from any further financial "help" and the US Department of Treasury keeps pressuring the European capitols to turn up the money by keeping Greece in and prevent it from pulling out towards Russia.

Hence, it must not be forgotten that the Greek event is an episode of the global crisis and of the clashes that emerged in the last few years even among the Western partners. Not by chance, the first episode of the Greek Crisis coincided with speculation of transnational finance of European sovereign debts and with the triggering of the Euro-crisis, on the background of the clash between the dollar and the euro. Today this did not happen, but the disagreements still reappear on the surface, deferring to the ultimate problem that stands beyond the umpteenth acceleration of the Greek situation: who must burn the uncollectible credits - and the Greek ones are only a very tiny part of global fictitious capital - and bear their cost? The clouds that gather on the global economy and on geopolitics - from the Eastern anti-Russian front to the burning Middle East and Mediterranean, from the deflation of the Chinese bubble to the coming raise of US interest rates - probably announce a new step of deepening of the global crisis. The great game on the Greeks’ skin tells us that the overall mood is changing.

To conclude, a few words about Tsipras and the Syriza debacle must be said, because the issue deserves far better in-depth analyses, and the "U-turn", that came unexpected for almost everyone, is not a mere personal event, attributable to treason against the Greek electorate or even limited only to the Greek scene. First of all, there is the objective-subjective nature of the complete isolation, on the European scale, in which the Greek population found (and still finds) itself in its attempt at resistance. And there is - in a probably very strong manner, even if it is impossible to evaluate it from here - the intrinsic ambivalence of this resistance between reclamation of dignity and of forms of life, and will to stay pegged to the euro and to Europe through it, in the face of a disruption that is perceived as a leap into the unknown. In the end, the euro that became almost a "fetish" is only the other face of , of an inadequacy of initiative and autonomous build-up, of an immaturity of the antagonistic social dynamics that must not be reduced to the mere Greek context but which speak about each one of us, if it is true that the European exploited classes now live in the illusion that it is better to avoid catastrophic developments of the crisis, hoping for the whole system to recover, sooner or later.

We must set herein the most swift trajectory of Syriza, that still amplified those inadequacies till a catastrophic outcome - even within most narrow spaces that do not concede any compromise. The case for a strong political reflection is that here there was played a constitutive, insurmountable deficit of the whole pro-Europe left: which prefers, for whatever reason, the European framework (a potentially unifying one, but only potentially) to the necessity, in some given conditions, of disruption with the command of finance. A disruption that can immediately be played, if it is organized and has a mass character, in order to take back higher levels of international unification of struggles. But because of this one cannot keep thinking that the two of us can and must save ourselves at the same time. Us from below and them above, by responsibly bearing the sacrifices (in order to be trashed away once we have been squeezed like lemons), or that an institutional camp is a guarantee of social and political recomposition at higher levels in itself. In the meantime, in the defeat, the question of an at least partial debt relief was posed for the first time. It will be necessary to come back to it in the future.