Home > THE POWER TO DESTROY

Justice Economy-budget Governments USA

THE POWER TO DESTROY

Tax crusader Irwin Schiff found guilty on all counts

Faces possible 43 years in prison, $3.25 million in fines for evasion

Posted: October 25, 2005

2:50 a.m. Eastern

© 2005 WorldNetDaily.com

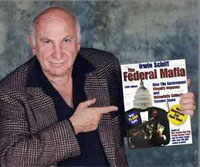

Irwin Schiff seen promoting his book, ’The Federal Mafia: How the Government Illegally Imposes and Unlawfully Collects Income Taxes’

Irwin Schiff, the Nevada man who has made a career out of telling Americans that payment of federal income taxes is voluntary instead of mandatory, was convicted on all 13 counts by a federal jury in Las Vegas yesterday.

Among the charges he faced was income tax evasion and of filing false tax returns for the years 1997 through 2002.

"People who evade their tax obligations, or encourage or enable others to do so, are cheating all law-abiding taxpayers," said Eileen O’Connor, assistant attorney general for the Justice Department’s Tax Division.

This marks the third time Schiff, who served as his own attorney during the five-week trial, has been convicted of tax-related offenses.

"Paying taxes is the price of citizenship. After three strikes, I would hope that even Schiff realizes that he has struck out," said Internal Revenue Service Commissioner Mark Everson.

Schiff, 77, faces a maximum sentence of 43 years in prison and $3.25 million in fines, and was ordered held without bail until his sentencing Jan. 20.

His co-defendant, Cynthia Neun, 52, faces up to 50 years and $3.3 million in fines for her conviction on 15 of 16 counts, including conspiracy, tax evasion, aiding in the filing of fraudulent tax returns.

Another co-defendant, Lawrence Cohen, 65, was found guilty of one count of aiding in the filing of fraudulent tax returns and acquitted on three other counts of the same charge, and of conspiracy.

For years, Schiff has been holding seminars and selling books such as "The Federal Mafia: How the Government Illegally Imposes and Unlawfully Collects Income Taxes" and "The Great Income Tax Hoax: Why You Can Immediately Stop Paying This Illegally Enforced Tax."

He believes the federal tax code doesn’t require U.S. citizens to pay income tax, and contends the IRS has no legal authority to seize property.

In June of this year, as WorldNetDaily reported, a former IRS agent who believes citizens are not required to pay federal income taxes was acquitted on charges he attempted to defraud the government.

Joseph Banister

Joseph Banister, a certified public accountant in San Jose, Calif., had been telling his clients they don’t need to file federal income tax returns because the 16th Amendment, which gives Congress "power to lay and collect taxes on incomes," was never properly ratified.

A jury in the U.S. District Court in Sacramento found him not guilty on a charge of conspiracy to defraud the government and on all three counts of aiding and assisting the filing of false tax returns for a client.

Banister’s attorney, Robert Bernhoft, told WorldNetDaily the result has no direct bearing on the legitimacy of the 16th Amendment, but he insisted the implications are bigger than the issue of taxes.

"The outcome shows that average, law-abiding, hard-working citizens are not going to criminalize speech - they’re not going to send a man to prison for asking the federal government serious questions about a serious subject," he said.

Previous stories:

Tax activist wins in federal court

Tax activist faces charges

IRS ’enforcers’ target ex-agent

Fed ’strike force’ targeting tax reformers?

IRS colluding with states?

Woman triumphs over IRS in tax case

Activist: ’Stop paying federal income taxes

National sales tax gains momentum

Tax reform still on group’s agenda

’Truth in Taxation’ forum ends in D.C.

Congressman cancels tax forum

Tax group urges Americans: ’Wait to file’

’Ghosts’ group threatens IRS employees

Activists refute IRS claims

IRS bashes ’frivolous tax arguments’

The Tax Man is hiring

IRS special agent challenges system

Forum posts

26 October 2005, 14:44

A federal jury delivered a blow to the anti-income tax movement on Monday by handing down 13 guilty verdicts against Irwin Schiff, a 77-year-old Las Vegan who has practiced and peddled the concept that paying taxes is voluntary.

Schiff faces a potential lengthy prison term and $3.25 million in fines for conspiring to defraud the Internal Revenue Service, tax evasion and filing false returns.

Advertisement

The outcome is the third time that Schiff has been convicted of tax offenses.

Schiff was handcuffed after the verdicts were announced and will remain in custody until his sentencing hearing on Jan. 20.

"I am going to fight these convictions on numerous grounds," said Schiff, who objected to the court decision to jail him.

"You have no reason to put me in jail," Schiff told U.S. District Court Judge Kent Dawson. "I am not a flight risk at all."

Dawson, who has exchanged heated words with Schiff over the course of the five-week trial, called the anti-tax guru a danger to the public.

Schiff represented himself during the trial, drawing several sanctions for contempt that will figure into his sentencing.

Dawson said that Schiff had proven to be "unmanageable in the courtroom" and had made the statement that: "All federal court judges are corrupt."

Dawson then upheld federal prosecutors who objected to Schiff’s release because they do think him to be a flight risk, with financial reserves in overseas bank accounts.

The judge also said Schiff is facing "what is tantamount to a life sentence."

"We don’t know what (resources) the government’s unaware of," said Jeffrey Neiman, trial attorney for the U.S. Department of Justice’s Tax Division.

Schiff’s former employee and girlfriend Cynthia Neun was found guilty on 15 separate counts, which included Social Security disability fraud on top of the conspiracy charges.

Prosecutors presented evidence that Neun was collecting disability without reporting that she was employed at Schiff’s business, Freedom Books.

Like Schiff, Neun was returned to the custody of U.S. marshals. A hearing is scheduled for 1 p.m. today in which prosecutors and the defense will make cases for why Neun should or should not be released until sentencing takes place on Jan. 27.

"At the very least right now, she should have the opportunity to get her affairs together," Neun’s attorney, Michael Cristalli, said. "There’s not evidence to suggest she won’t show up at any court appearances."

Neiman made clear that federal prosecutors would oppose Neun’s release and said that she recently had inherited $25,000 from her father’s estate, providing her with the resources to flee.

The only defendant jurors seemed to find sympathy with was Lawrence Cohen, who was acquitted of conspiracy charges and found guilty on one count of aiding and assisting an individual prepare a false tax return.

Cohen, also a former employee of Freedom Books, was relieved for himself but said he was concerned about the fate of Neun and Schiff.

"I am sad," said Cohen, the only one of the three to leave federal court a free man, at least until his sentence is handed down Jan. 27.

The results angered Schiff supporters and those who endorse "tax honesty."

Schiff, author of "The Federal Mafia: How the Government Illegally Imposes and Unlawfully Collects Income Taxes," was at the forefront of those who contend that no law exists that requires people to pay income taxes.

He drew the attention of the IRS when thousands of people submitted Schiff’s "zero returns," which calls for listing zero income on tax returns.

"He’s 100 percent innocent, that’s what I think," said one 44-year-old man who has attended the trial regularly.

"He was never allowed to put on a defense. ... This is a travesty. The people with the tax honesty movement aren’t a bunch of wackos who are just trying to twist the law in their favor."

The man declined to give his name and said he feared retaliation from the IRS.

IRS Special Agent J. Wesley Eddy, assigned to Las Vegas, said the Schiff verdicts demonstrate no gray area exists on the issue of paying income taxes.

"Today’s conviction sends a clear message that we are committed to vigorously enforcing the tax laws," Eddy said.

Steve Johnson, a professor for UNLV’s Boyd Law School, has followed the developments of the Schiff trial.

He teaches tax law and said he expects the conclusion will deflate the tax protest movement to some extent because the guilty verdicts show that Schiff’s ideas will not hold up in court.

"This is a huge win for the government and will have national repercussions," Johnson said.

Because of limited resources, Johnson said, the IRS chooses to prosecute about 3,000 criminal cases a year.

To make the cut, a case has to be high-profile and involve someone who is a visible figure. Schiff, Johnson said, has been an important leader among tax protesters for 30 years.

Johnson said he understands Dawson’s decision to return Schiff to police custody.

"He’s not a danger because he’s the guy with a machine gun," Johnson said. "But look at what he’s spinning. Who has it hurt the most? The people hurt most by Schiff are the people who follow him."

26 October 2005, 14:45

FLASH NEWS! Judge Kent J. Dawson just wrote the law compelling the filing and paying of the income tax!

FLASH NEWS!

JUDGE KENT J. DAWSON JUST WROTE THE LAW COMPELING THE FILING AND PAYING OF THE INCOME TAX!

See it here for the first time.

At the beginning of the Erwin Schiff trial Judge Dawson and his assistants, the prosecution team, had a major problem. The illegal search of Mr. Schiff’s offices had revealed the fact that Mr. Schiff could prove neither Nevada Senator John Ensign, Hawaii Senator Daniel Inouye, the Library of Congress, the Secretary of the Treasury nor over 300 IRS agents could find a law that required resident citizens of the United States to file or pay income tax.

But that wasn’t Judgie Poo Dawson’s only problem. He was also aware that more and more of the citizens that had been illegally prosecuted for tax crimes were being found not guilty because of that silly little quirk in the law that there is no law. Being a quick study Judgie Poo must have realized if this keeps up no one will pay the income tax. Then, it’s reasonable to believe his first thoughts were, “Heavens to Betsy that will mean the government will get rid of its inferior federal judges! No more houty touty country club! No more bowing and scraping to me! No more extra curricular activities in Pahrump’s Chicken Ranch! And, and, God Forbid, I’ll have to find a real job!”

However, you just can’t keep a good man down. So Judge Dawson decided to interpret the tax code as being the world’s largest word anagram dictionary. Therefore, in Judge Dawson’s brave new world if there are words, contained anywhere in the tax code, that one could use to construct a law requiring the citizens to file and pay taxes on their income from wages, then the citizen is required by law to pull those individual words out and put them together in a somewhat cohesive sentence which spells out such a law. Then, that becomes the law they are to obey because the individual words did come from the tax code. Now I know Mr. Schiff has seen it all, but I’ll bet even Mr. Schiff would admit Judge Dawson’s criminal and cunning misuse of the tax code in this manner is creative and unique.

However, apparently during this trial Judge Dawson decided the jury was incapable of word anagram construction. So, being ever diligent in his proven partisan pro prosecution quest for injustice, during one of his illegal exparte meetings with the prosecution (one of which is Mormon, as is Judge Dawson) he constructed the law which compels the payment of income tax. Unfortunately some of the words Judge Dawson wanted to use were not in the tax code so he declared, because his is a life time appointment, he can do anything he wants to. So, in addition to section 1 of the tax code he included the writings of the Prophet Joseph Smith on Polygamy and the entire works of the Brothers Grimm fairy tales in his source material.

Even though I fear being sanctioned with jail time for revealing the new law prior to judge Dawson springing it on the jury and Irwin, as a patriot I am compelled to do so.

Therefore I present to you the new and improved law requiring the filing and paying of income tax as authored by his most honorable Justice Kent J. Dawson

PREAMBLE

When in the course of inhuman events it becomes evident the government’s group of hit-men known as the IRS ass is on the line it is incumbent on all federal judges to come to the rescue. Therefore, I, the most Holy and respected Federal Judge Kent Dawson have on this day of our Lord came down from Mount Charleston (just north of Las Vegas) with the law, written in Crayon, on the back my W-4 exemption form, by the hand of an anonymous stranger who resembled Charlton Heston complete with long flowing white hair who was given immunity from prosecution by the federal prosecutor.

IRS Tax Code Number 0

All money or valuables in excess of $6,000.00 earned annually by anyone, including butchers, bakers, candlestick makers and ugly hookers, residing in the United States are subject to income tax and must be reported on a 1040 form and paid to the IRS within twenty four hours of receipt of such money or valuables. This law expressly includes people named Irwin Schiff, Cindy Neun, Larry Cohen and everyone they know.

Evidence of the violation of this law includes the placing of funds in any financial institution which IRS agents cannot intimidate into giving said funds to them.

The penalty for failure to adhere to this law is to be sprayed with mace and immediate incarceration in a dark, damp dungeon with no benefit of trial and the confiscation of all property the IRS decides it wants which includes any expensive golf clubs monogrammed with K.D.

However, this law does not include Halliburton or any major oil company or its higher echelon personnel, anyone friendly with President Bush or anyone in his administration or any person making in excess of $200.000.00 who has a lawyer to degrease the skids of justice or take advantage of all the loopholes provided for the preferred class of people.

Exempt Gifts

All gifts of money, land, *stocks and bonds or vacations to government officials i.e. Congressmen, Senators, Members of City Councils, IRS agents, Federal Judges and Prosecutors ECT.

* This includes stock split tips or the profit on inside information given to the cronies of all of the above on where new highways will be built.

Non-exempt Gifts

All rent, electric and phone bills paid by a boy/girl friend unless proof of the relationship is provided in the form of a semi monthly video tape of explicit sexual activity between them is given to all the male IRS agents, the male federal prosecutors and all judges regardless of gender.

All deadbeats that are not required to file or pay income tax must fall into one of the following groups.

1. Any little old lady who lives in a shoe and is straddled with a bunch of brats.

2. Anyone who’s diet consists entirely of Curds and Whey and lives on the *streets out of sight of respectable people. *Authors note > more specifically not living in tent city which Judge Dawson has previously ruled was a stinky blight on society and repugnant to society.

3. All people who know where the skeletons are hidden that would cause problems for high placed people, such as federal judges.

4. Those IRS agents (30 percent) who know where their fellow agents and superiors skeletons are hidden and already do not file or pay income tax.

5. Any employee of the Chicken Ranch in Pahrump.

6. Any old woman named Hubbard that is too poor to buy a bone for her dog unless such dog is not flea ridden and is a pure bred which an IRS agent’s child would like.

7. Any person who feeds a mob with one loaf of unleavened bread and rises from his grave after being nailed to a cross. (***However, this exemption from income tax is subject to Judge Dawson and the prosecution team being forgiven for all the illegal crap they are doing to Erwin Schiff et all.)

*All laws preventing exparte communications between judges and prosecutors are hereby stricken from all federal codes.

**All persons observing or telling others about observing the ending of an exparte meeting between Judge Dawson and the federal prosecutors of Irwin Schiff et all shall be sanctioned with 5 days in jail. If Irwin Schiff complains, in open court, about such a meeting he shall have his time in jail doubled and redoubled.

*** If the demand for forgiveness by J.C. mentioned in number 7 is ruled to be overreaching then the prosecution team should go straight to hell but the obviously innocent, of any favoritism or criminal malfeasance during this trial, Judge Kent J. Dawson must be forgiven.

The Constitutionalist

Kent J. Dawson,

United States District Court Judge,

U.S. District Court of Nevada,

333 South Las Vegas Boulevard,

Las Vegas, Nevada 89101

No need to put Hon befor his name there is nothing honarable about him

Be sure to let this baboon know how you feel about him. Maybe someone can find him a job in North Korea or Zimbabwe I am sure that he will be able to teach them something.

John

26 October 2005, 15:23

If America had judges who worked with the law, instead of trying to subvert it for the benefit of themselves and all the illegal "leadership" of the country, this case would have been thrown out of court long ago. And anyway, I thought it was Congress and the President who created laws, not some hack of a judge! I like playing with anagrams myself, but regard them as fun, not something used to bludgeon people with.

26 October 2005, 21:25

This whole trial was a sham from the beginning. A waste of tax payer dollars. More people are aware of the tax fraud that has been put on the American people than the government wants to admit. What the judge did, not allowing the jury to review the tax CODE, not tax LAW, is wrong. This man, the judge, violated the law and should be removed from the bench. When the masses unite together, the people’s WILL, will become law. Through the traitor out!

As for Irwin Schiff, we hold you in high esteem for taking a stand for life, liberty and the pursuit of happiness. The truth will prevail.